IMF SDR allocation: Interesting in theory

20 March 2020

The International Monetary Fund (IMF) is meant to help in times of financial distress. The covid-19-induced crisis has brought forward calls for the IMF to mobilise new resources to support a tormented international economy. In response to the global economic and financial crisis, the IMF made an allocation of new Special Drawing Rights (SDRs). SDRs are viewed as an effective way to increase international liquidity. However, existing provisions for SDR allocations and more importantly the fact that countries do not use SDRs seem to make this a futile approach. The SDR would have to change significantly to serve as a meaningful response to a crisis.

The SDR represents an international reserve asset. It is meant as a low cost liquidity buffer for emerging markets.1 SDRs can be exchanged for freely useable currencies on demand. Freely usable currencies are currencies that are widely traded on the principal exchange markets and used to make payments for international transactions. SDRs do not constitute IMF resources or claims on the IMF and only serve for transactions with the IMF and some designated agencies. There are SDR204.2 billion (USD275 billion) SDRs outstanding.

SDRs allocations are made rarely. There have only been four general allocations since creation of the SDR in 1969. Allocations require the approval of the Board of Governors with an 85 percent majority of the total voting power. In August 2009, the IMF made a new allocation of SDR182.6 billion (US$250 billion) SDRs. It was seen at the time, as a needed response to increase financial resources of countries to meet international payments.

SDR allocations are made in proportion to IMF member countries' quotas, countries' financial and voting shares in the IMF. This implies that most allocations go towards advanced economies. Of the SDR182.6 billion allocated, emerging markets excluding China and E.U. countries received SDR61.6 billion or 33.7 percent of the total. The E.U. obtained SDR50.7 billion, U.S. SDR30.4 billion and China SDR6.8 billion.

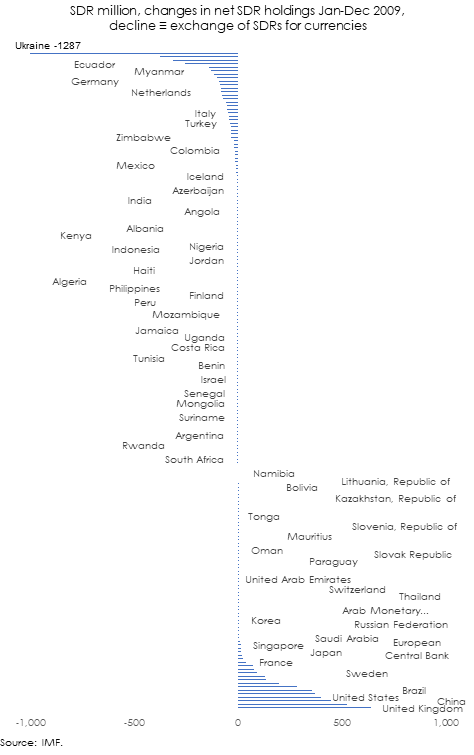

Figure 1. SDR use

The SDR mechanism implies that countries to use their SDRs sell all or part of their SDR allocations in exchange for currencies to meet balance of payment pressures. Countries need to accept buying SDRs, normally the advanced economies, to allow an exchange of SDRs for currencies, that is, the U.K. and the U.S. had been among the largest buyers of SDRs. The difference between SDR allocations and SDR holdings, net SDR holdings, shows to what extent countries use SDRs. In January 2009, negative SDR net holdings, that is, SDR holdings smaller than SDR allocations, were SDR7.6 billion of which emerging markets excluding China and E.U. member countries were SDR3.9 billion. In December 2009, negative SDR net holdings were SDR9.2 billion of which emerging markets were SDR5.1 billion. Between January and December 2009, negative net SDR holdings thus increased by SDR1.6 billion and for emerging markets by SDR1.2 billion, that is, of the SDR allocation of SDR182.6 billion, emerging markets excluding China and E.U. member countries exchanged SDR1.2 billion (US$1.9 billion) for foreign exchange (Figure 1). By December 2010, near the end of the immediate crisis, they had used SDR1.9 billion (US$2.9 billion).2

The SDR has repeatedly failed to make an impact. While the SDR could represent a potent instrument to mobilise resources, IMF member countries have never embraced it. The high voting threshold has normally made it near impossible to achieve consensus to authorise allocations thereby not providing the needed flexibility to respond to a financial crisis in a prompt manner. The fact that SDRs cannot be used outside the IMF and some designated agencies has greatly reduced its practical relevance to serve in international transactions. SDRs allocated to IMF member countries count towards their central banks' international reserve assets but typically represent only a very small proportion of overall international reserve holdings.

The IMF would need to adopt broad-based changes to enable the SDR to play a relevant role. Provisions would need to include facilitating frequent SDR allocations in considerable amounts. The IMF Articles of Agreement, the treaty underlying governance and operations of the IMF, grants some flexibility for making SDR allocations amid unexpected major developments. The voting threshold would have to be changed to a simple majority of the voting power to gain the required agility to act fast. Allocations should be allowed to deviate from existing quotas. SDRs would have to be used by market participants to readily serve in financial transactions and give rise to a financial market infrastructure for SDRs. The value of the SDR, fixed to a currency basket, should float to allow the SDR to reflect supply and demand for SDR resources.

The SDR has met neither intent nor expectations. SDR allocations are skewed towards countries that do not need them. Those that hold them do not use them not even during severe crises. The last SDR allocation resulted in only a paltry new net conversion of SDRs for currencies by emerging markets. Considerable changes would be required first to make the SDR useful. Those are unlikely to materialise any time soon. SDRs are remarkable instruments in theory but are mostly ineffective in practice.

1 IMF press releaseIMF Executive Board Backs US$250 Billion SDR Allocation to Boost Global Liquidity, 20 July 2009.

2 SDRs are exchanged normally under voluntary transactions. The IMF can activate a designation mechanism by which IMF member countries must exchange SDRs for freely usable currencies. SDR transactions can consist of pledges, swaps and forward operations but in practice consist of spot sales and purchases of SDRs against freely usable currencies (IMF, 2016).