Covid-19 propels private currencies

22 May 2020

The announcement of 14 May of Singapore’s Temasek joining the Libra Association may signal that private currencies could benefit from weakened official actors. The expected permanent adverse impact of the covid-19 induced economic crises in particular on official solvency will raise questions about trust and stability of official currencies. Like other severe economic crises in the past, covid-19 may lead to a rethink of currency arrangements. Temasek may just have revealed that this should involve private currencies.

The depression-like economic data coming out of the U.S. and other countries will raise generalised doubts about the stability of official currencies. When the U.S. sustained the gold standard in 1929-33 during the Great Depression, many had wished it hadn’t to alleviate the crisis then. The U.K. left the gold standard in 1931 for the same reason. Reliance on official currencies may simply be too risky if countries are in the doldrums and will do anything to revive fortunes at home even if it means sacrificing currency stability.

The Libra Association is planning to issue several private currencies. It recently revised its original offering and now aims for a number of currencies fixed to national currencies. In a national territory with a stable official currency this may not add much. In a national territory where a large share of the population does not have access to effective payment media, where acquisition of the currencies has been solved and where foreign currencies are being tolerated this may be a big contribution to financial inclusion. In a national territory with an unstable currency, this may be a boon. For international payments, using a common currency would make payments far easier.

There is a priori no reason why private currencies may not serve as effective settlement media. Most monies are already private representing liabilities of the banking system. Private entities offer other vital services including health and life insurances. While official monies provide critical functions to uphold monetary stability as lender of last resort and for implementation of monetary policy, private currencies may serve as effective transaction and savings media.

The case for private currencies rests on the limitations of official currencies. Official currencies serve to advance official policy objectives that are normally limited to the national territory. For many economic actors it may not be optimal to hold a currency that has been calibrated for the national territory. The idea to use currencies that may be more aligned with one’s own economic ecosystem that would normally not be congruent with the national territory is appealing. Herein lies the rationale of private currencies. Would one be better off using a currency that is optimal for say an Amazon-dominated ecosystem? The answer may be yes. Though fear of "dollarisation" will always produce pushback.

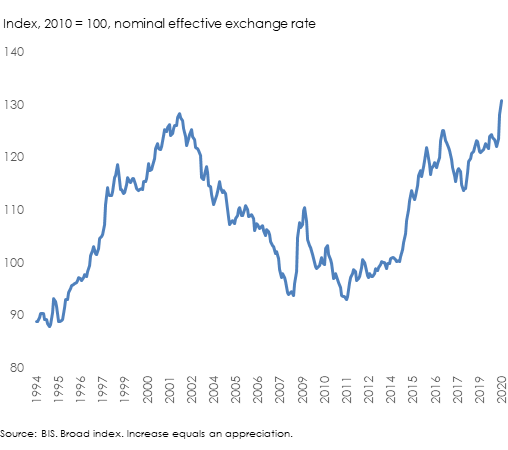

Most official currencies have had a terrible track record. High inflation and sharp exchange rate depreciations have marred most currencies during the past few decades. Few would suggest official currencies offer needed stability other media could not also provide. Central banks have suffered from credibility deficits for decades and many had pegged their currencies to other currencies to build trust and install stability as the dollar and sterling were fixed to gold. Once stability had been achieved, central banks would try to float their currencies to gain more monetary policy freedom. Many were forced to float (remember the 1992 ERM crisis). For most central banks exchange rate stability remains a challenge (Figure).

Figure. U.S. dollar

Temasek's membership in the Libra Association may mark a new start but also a more conventional approach. The Libra Association may aim to attract other established entities like banks and regain those it lost like Visa and Mastercard. In principle those actors would facilitate the orderly integration of the Libra currencies into existing financial systems. Yet, the greatest gains will likely come from exploring new systems. Eventually, the Libra currencies may float too of course.

Covid-19 compels all economic actors to rethink how a post-pandemic world will look like. Severe economic crises normally invite reform of existing monetary arrangements. In 1931, the gold standard more or less ended due to the Great Depression. In 1945, the Bretton Woods system was set up as a new approach to monetary relations and framework for stability after the war. In 1971, when the Bretton Woods system collapsed, in large part on the back of severe economic difficulties in the U.S., it led to new floating exchange rate regimes. Today’s crisis may have a similar effect. With many key official actors severely damaged, the emergence of private currencies may be seen as the new direction for needed monetary reforms.