Financial inclusion: A role for CBDC?

Prepared for R3 CBDC webinar Building CBDC: The race to reality

22 July 2020

Financial inclusion remains a major challenge in particular in low income countries. Central bank digital currencies (CBDC) have often been associated with a new approach to facilitating financial inclusion. However, digital central bank money for low value high volume transactions does not seem essential and many alternatives exist as suggested by the increase of digital payment means in many countries. Kenya is a leader for mobile payments and has seen a significant rise in the adoption of financial accounts associated with M-Pesa. On that basis, the case for CBDC for financial inclusion seems weak.

Financial inclusion is normally associated with the notion that “[…] individuals and businesses have access to useful and affordable financial products and services that meet their needs—transactions, payments, savings, credit and insurance—delivered in a responsible and sustainable way (World Bank).” Financial access undoubtedly plays a major role in facilitating economic participation and integration and helps household and businesses plan ahead and meet contingencies as a fundamental basis for improving lives.

Financial inclusion has become a major international public policy initiative. Since 2011, 1.2 billion adults have gotten access to an account and today more than two thirds of the adult population has an account. However, 1.7 billion adults remain unbanked. Account access and account usage also still differ significantly including in countries with a high account penetration rates like China, Kenya and Thailand.

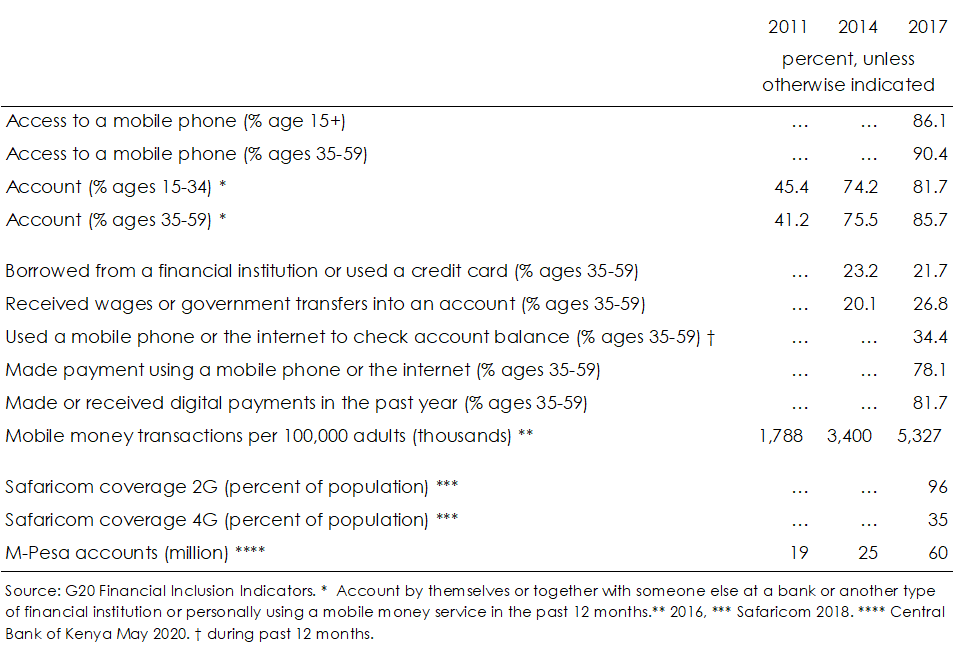

Figure 1. Kenya financial inclusion indicators

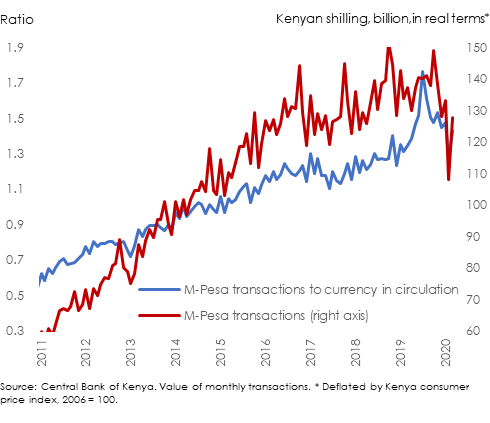

Kenya is a good example of rapid progress in financial inclusion. The percentage of adults holding an account increased from 41 percent in 2011 to 86 percent in 2017. Much progress can be attributed to the adoption of private telecommunications operator Safaricom mobile phone based payments M-Pesa. M-Pesa was introduced in 2007 and saw very widespread adoption with the number of registered accounts increasing to 19 million in 2011 and to 60 million in 2020 (Figure 1). The average monthly transaction value adjusted for inflation more than doubled between January-May 2011 and January-May 2020 (Figure 2).

M-Pesa has 37 million active users and has far outstripped card and other digital means of payments. It enables users to send, receive and store money balances safely on a basic smart phone. It does not require users to have a bank account. M-Pesa also allows businesses to take payments from customers and pay salaries and can be used for disbursement of social security payments. Conversion of M-Pesa balances into cash and vice versa is one of the principal M-Pesa activities at an M-Pesa agent. There are more than 240,000 agents to offer M-Pesa cash in/cash out services up from 50,000 at end-2011. Cash can also be withdrawn at ATMs. Merchants can accept M-Pesa with Lipa Na M-Peso making possible payments at the point of sale of up to KS70,000 (US$645). M-Pesa also offers loans in partnership with Commercial Bank of Africa (CBA) through the micro-savings and micro-credit product M-Shwari with a loan limit of about KS50,000 (US$460).

M-Pesa is cash intensive. The proportion of M-Pesa transactions by value has increased gradually relative to currency in circulation showing mounting substitution of M-Pesa balances for cash though reverted back somewhat (Figure 2). This suggests as a very broad proxy only that M-Pesa while being a substitute of currency is also a complement.

Figure 2. M-Pesa and cash

M-Pesa seems to have solved access to digital payments but may not have solved acceptance. While 86 percent of the adult population (ages 35-59) has an account, only 27 percent received wages or government transfers into an account and 34 percent used a mobile phone to check account balances (Figure 1). It may indicate that M-Pesa is used for repeated one-off cash withdrawals, more like a bank account and less as a payment medium. The adoption of M-Pesa by merchants may play a role and so will payments of salaries. The low incidence of borrowing, while M-Shiwari has had a significant impact on loan disbursements, with only 22 percent who borrowed from a financial institution in 2017, it suggests that M-Pesa may not yet have brought needed financial deepening.

The role of central banks to push financial inclusion is ambiguous. Where a market solution exists, the role of the central bank would be to regulate. Where a market solution cannot be achieved, it is not certain a central bank solution could. The role of the telecom operator is critical to build the needed infrastructure to allow payments as to a large extent financial inclusion will depend on atual access. Cash in/cash out providers seem essential to facilitate access to cash in particular as acceptance of alternative media seems to remain limited necessitating a conversion into cash. However, dominant market players may pose other risks of undue market power. Diversification and choice are important attributes of a well functioning market. The role of the central bank may depend on whether those objectives can be achieved with its intervention.

Central banks money remains the safest of all monies in a given currency area. The use of central bank money in retail payments would mitigate most payments related risks for payment providers when receiving payments on their behalf or on behalf of end-users from a third party. CBDC could help reduce transaction costs making payments cheaper and safer.

Financial inclusion is about access to reliable payment media but also especially about banking services. While CBDC may reduce transaction costs, rapid adoption of M-Pesa suggests costs by private operators are not unduly high. Financial deepening remains a bank business and central banks would struggle to provide effective consumer- and business-facing saving and loan services. Kenya shows access to payments and financial inclusion are complementary. CBDC alone will not suffice but a push by telecom operators and banks probably could.

1 The adoption of M-Pesa has been accompanied by the near universal availability of a national identity card in Kenya.