Has the IMF done enough during the pandemic?

LSE School of Public Policy, Dean's Dialogue

Prepared remarks, 31 March 2021

Dear LSE Students,

I am most grateful and delighted for the opportunity to speak to you here today. I wish we could do this in person. I wanted to offer some prepared remarks and would then look very much towards a discussion around the topic I shall present. I wanted to speak about the IMF and debate whether the IMF has done enough during the pandemic. With the IMF Spring Meetings on 5-11 April, there will probably be some debate about the role of the IMF and in particular whether the IMF should be given more resources. The IMF Board also held an informal meeting on the case for pushing for a Special Drawing Rights (SDR) allocation of about US$650 billion. I argue that while the IMF matters greatly, before increasing IMF resources and issuing more SDRs, there should be sufficient confidence that the IMF can deploy its resources and that SDRs are actually being used. Prima facie evidence suggests that neither is the case.

The risk is that the IMF is set to do more of the same without asking the more difficult question, namely are its instruments still fit for purpose? Reform should precede considerations for any additional resources. Most of those changes have been called for some time.

I shall focus on the IMF's actions during the pandemic and on SDRs. But before, I shall offer a very quick review of what the IMF actually is and does.

IMF

The IMF is a specialist organisation of the United Nations. It was founded in July 1944 at Bretton Woods, a small town in New Hampshire, United States, hence the term Bretton Wood institution, as a key effort pushed by then U.S. President Roosevelt to offer a framework for restoring orderly exchange market conditions after World War II to a allow a prompt resumption of international trade seen as essential for the post-war economic recovery. The IMF was established as a permanent institution to offer consultation, advance cooperation on international monetary problems and make available IMF resources temporarily to help countries' making needed balance of payments adjustments.

Since then, the IMF adapted to changing circumstances and became increasingly an institution to support emerging markets and developing countries facing severe external debt problems. The IMF normally intervenes when countries no longer have sufficient freely usable currencies, dollars, euros, yen, etc., to meet immediate external debt obligations. The IMF would then lend to countries freely usable currencies, countries would purchase those currencies from the IMF, subject to so called conditionality, to undertake measures to avoid facing those debt problems again. The IMF is therefore seen as a lender of last resort for countries and as such an essential pillar of the global financial safety net.

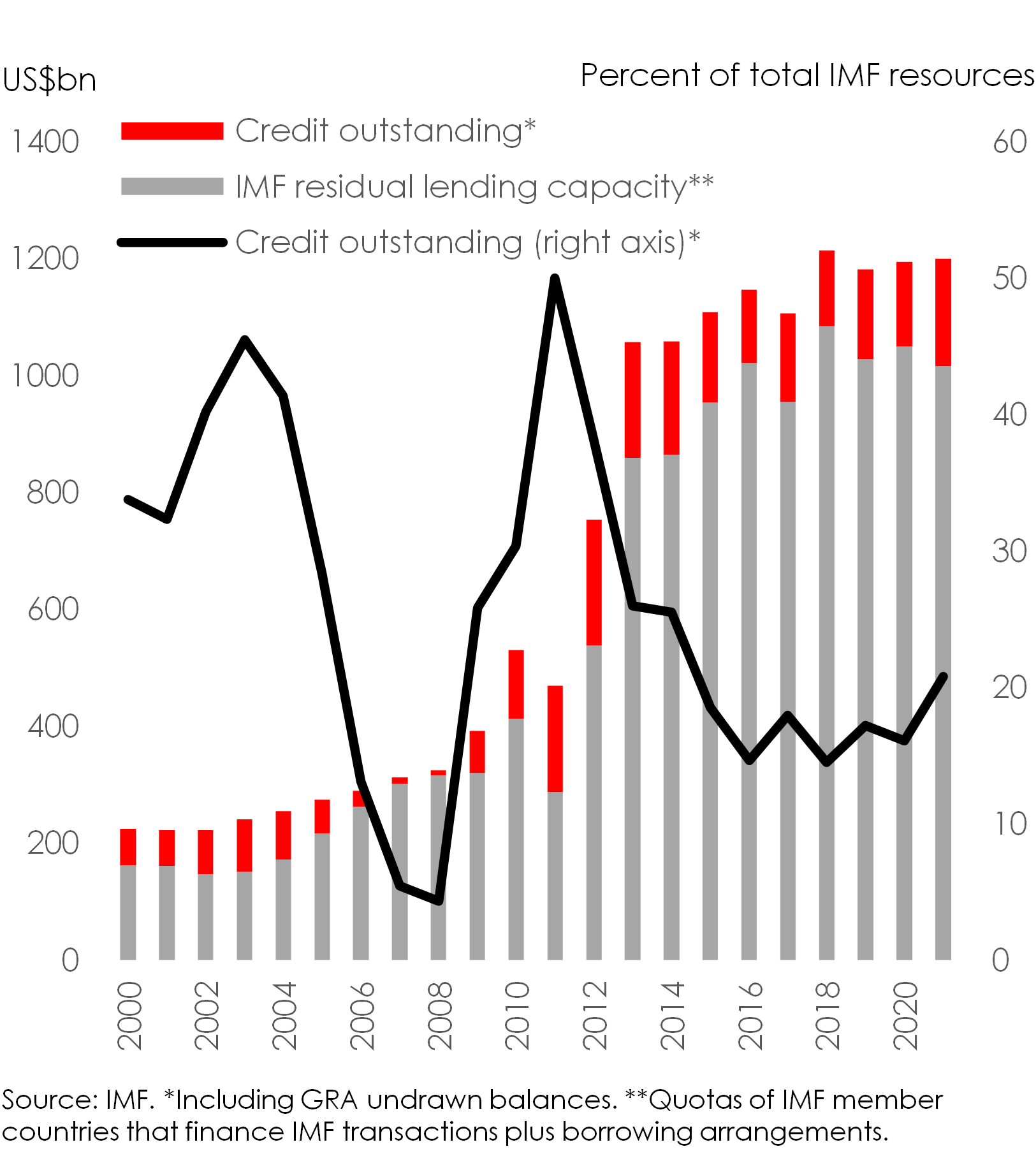

The IMF matters in large part because it can lend. Its resources stem from quotas and borrowing arrangements. Quotas are permanent resources representing countries' de facto financial share in the institution that are determined broadly by the country's economic weight in the international economy and that also set the voting power of the country at the IMF Executive Board, the body responsible for running the day-to-day operations of the IMF. Borrowing arrangements are temporary resources and activated once quota resources are exhausted based on multilateral borrowing as a second line of defence and bilateral borrowing as a third line of defence. The IMF today has about US$576 billion (SDR400 billion) in usable quota resources and US$705 billion (SDR489 billion) in borrowing arrangements or total resources of US$1281 billion and a residual lending capacity before liquidity buffers, full activation of borrowing and after credit outstanding and undrawn balances of about US$1000 billion.

IMF conditionality can be very strict. This is due to the fact that by the time countries approach the IMF the most drastic measures are needed but also because calibrating adjustment measures is very hard. IMF borrowing depends on the perceived opportunity cost of engaging with the IMF that are often also political.

Countries need to trust the IMF and perceive that they are being treated fairly. IMF governance reforms have been called for for some time to ensure the institution has the countries' buy-in and that countries feel they are represented equitably. China has remained significantly un-represented with its quota share only the third largest on par with Japan's. Adjusting China's quota remains one of the biggest governance challenges for the IMF.

IMF and Covid-19

The Financial Times posted a comment piece by me on 28 March 2021 in which I question whether the IMF remains an effective pillar of the global financial safety net. It caused a tiny little bit of a debate. The Covid-19 economic crisis, the most severe economic crisis since the Great Depression, should have been a moment for the IMF to shine. Yet I argue the IMF only mobilised about US$100 billion in additional resources or 10 percent of its available resources of more than US$1,000 billion. The Financial Times subsequently published a letter by the IMF Director of Communications Gerry Rice who argues basically that my and it seems all criticism is unfounded.

My argument is a simple one. The most severe economic crisis should afford countries a mix of financing resources of which the IMF should be a critical one. While the IMF may argue that it stands ready to supply assistance, it needs to ensure countries demand it. A financial safety net that no one uses or only under the severest distress incurs undue economic costs and may simply be ineffective.

The IMF projects annual world GDP in 2020 to have contracted by 4.4 percent year-on-year. In 2009, amid the global financial crisis, annual world GDP shrank by 0.1 percent. Countries’ external debt increased by US$4,900 billion from end 2019 through the third quarter of 2020.1 The IMF itself has warned about a looming emerging markets debt crisis. It should therefore have done much more to provide external assistance.

The IMF affirmed early on it stands ready to support countries. During the IMF Spring Meetings in April 2020, IMF Managing Director Kristalina Georgieva advertised: “[W]e have $1 trillion lending capacity—4 times more than at the outset of the global financial crisis [and] have taken exceptional measures […] sought to maximise our ability to provide financial resources quickly […] to ease liquidity constraints and provide space for priority outlays […].”

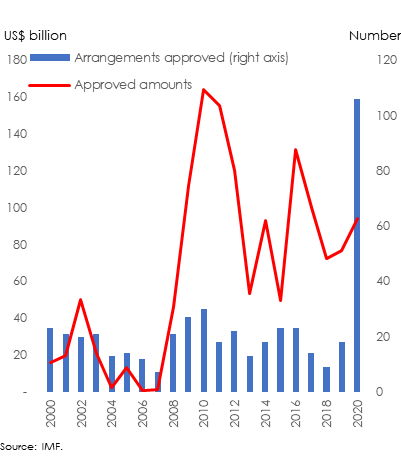

Between end-January 2020, when Covid-19 was declared a pandemic by the WHO, and January 2021 the IMF extended lending commitments based on my calculation by gross US$97 billion (Figure 1). During that period, a record 111 arrangements were approved (Figure 2). Excluding flexible credit lines (FCL), that are normally not activated, total new lending commitments were US$52 billion. The average amount approved, in percent of IMF quotas excluding FCLs has been 76 percent or US$481 million the lowest since the global financial crisis.

At the outset of the global financial crisis, between September 2008 and September 2009, the IMF approved new lending commitments of US$153 billion and US$75 billion excluding FCLs. 34 arrangements were approved with the average amounts excluding FCLs representing 340 percent of quota or US$2,415 million.

Hence, the IMF has done relatively little and much less than during the global financial crisis.

Figure 1. IMF credit outstanding

Figure 2. IMF new lending commitments

SDRs and Covid-19

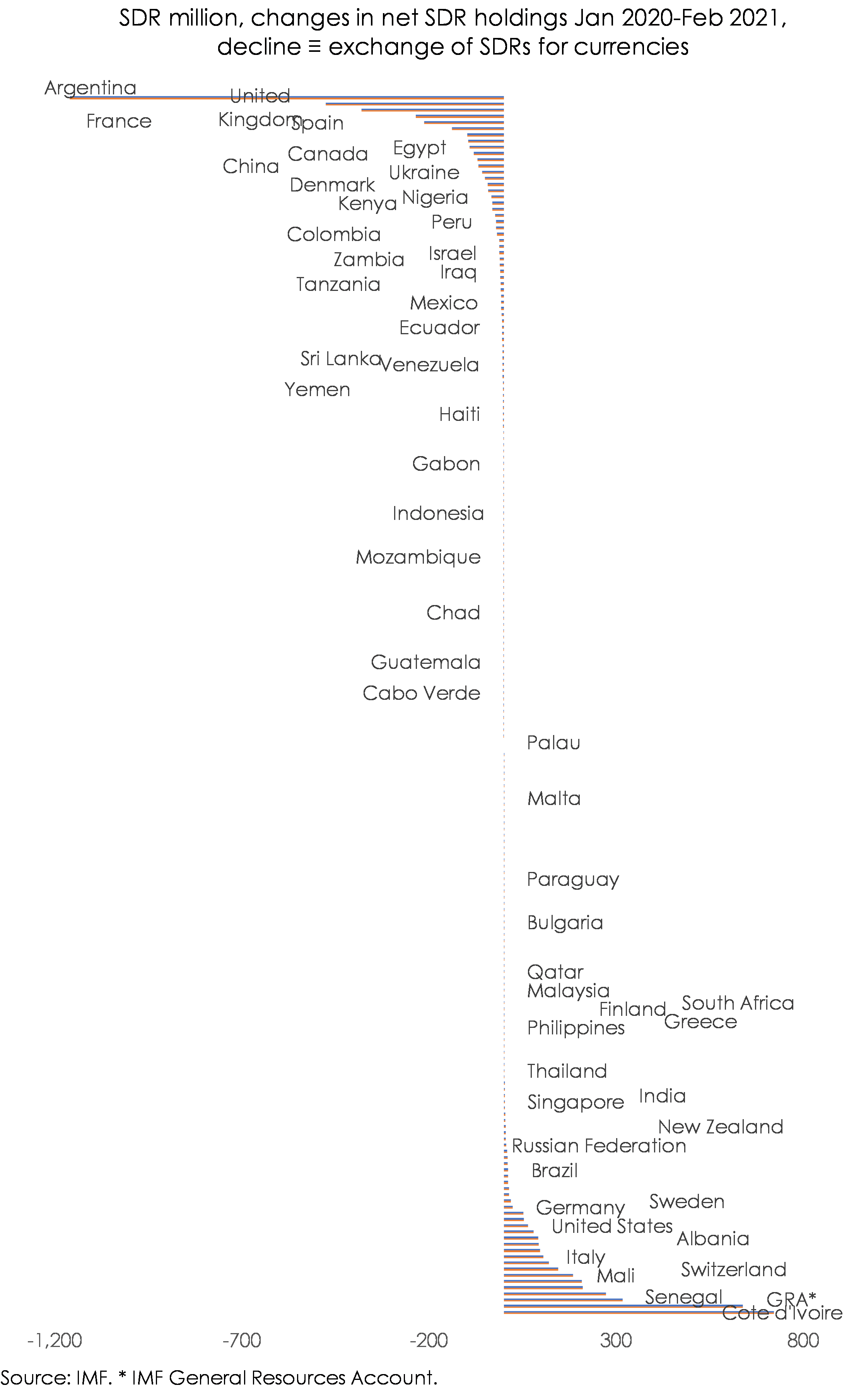

A general SDR allocation now seems certain. Earlier, U.S. Treasury Secretary Janet Yellen hinted that the U.S. was in favour. Prominent academics have also thrown their weight behind it. But the fact is countries do not use SDRs. During 2020 and early 2021, emerging markets and developing countries have mobilised only a sparsely 0.1 percent of their total SDR allocations. SDRs need to be used to make an allocation worthwhile.

The SDR has a long and troubled history. In 1989, IMF Executive Director Alexandre Kafka famously noted, "as long as the Fund membership does not have more enthusiasm for the SDR than it has shown recently, the Fund’s own basket currency can only remain a 'basket case'."2 IMF member countries have historically been divided about the need for more SDRs with much resistance from the large European countries. The requirement of a special majority for an allocation means there is limited scope to meet SDR demands flexibly. SDRs can only be used for operations within the IMF and with a small number of multilateral entities or prescribed holders. The private markets cannot use SDRs.

SDRs are issued to IMF member countries. They are a perpetual credit line for freely usable currencies of IMF member countries and considered a supplement to foreign exchange reserves. If countries face an external shock, SDRs could be exchanged for dollars and used towards countries’ external debt services. That is the theory.

SDR issuances or allocations require 85 percent of the voting power of IMF member countries. Hence, that is why since 1970, there have only been three general allocations. Because the U.S. holds 16.5 percent of the voting power at the IMF Executive Board, its support is necessary. If allocations are large, in excess more or less of US$650 billion, the U.S. Congress would also have to approve it, a complication the U.S. government will choose to avoid.

There are SDR204 billion (US$294 billion) SDRs outstanding. The distribution of SDRs rests on the distribution of IMF quotas. Emerging markets and developing countries including China and excluding E.U. countries have been allocated 37 percent of SDRs issued.

SDR allocations are ‘cost free.’ In an SDR allocation, every country is given an SDR asset (holding) and an SDR liability (allocation). If a country holds fewer SDRs then allocated, its net holding is negative. Changes in net holdings show to what extent countries use their SDRs.

Between January 2020 and February 2021, emerging markets and developing countries including China reduced by SDR0.1 billion their net SDR holdings out of a total of SDR76 billion in allocations. During that period, amongst the largest users of SDRs to obtain foreign exchange were the United Kingdom, France and Spain, countries not normally associated with facing acute foreign exchange shortfalls (Figure 3). During the global financial crisis in 2009, the mobilisation of SDRs after a large allocation in August 2009 was similarly modest. The limited use of SDRs and outdated allocation rules mean SDRs sit mostly idle. That is the practice.

Figure 3. SDR usage

Conclusion

To conclude, I believe the IMF needs to do much more to serve as an effective central pillar of the international financial safety net. Two considerations are key: i) the IMF must make sure its resources can be deployed at scale in times of heightened distress; 2) SDRs will have to be used to serve as international liquidity support.

The IMF keeps insisting it wants a big bazooka. But it has not shown it knows how to use it. If not during Covid-19 then when? The IMF ought to rethink how to make its facilities more relevant and its resources more accessible. The new arrangements, the Rapid Credit Facility and Rapid Financing Instrument, have already attempted to do that but are available only for relatively small amounts. Conditionality will need to be recalibrated to reduce the opportunity cost of using IMF resources and allow the IMF to engage not only as the last but also prior to last resort.

SDRs need to change. Calls for change are of course not new. Allocations should deviate from quota shares to allow countries in distress to get SDRs. Allocations should be made more flexibly through for example a large allocation envelope. There should be more prescribed holders including private market participants. The SDR valuation basket, currently made of 5 currencies, should be expanded to a large number of currencies to make the SDR more attractive as a financial instrument and the SDR should be valued based on market forces to enhance its use as a unit of account. The SDR should also go digital to leverage on new technologies to make it more accessible to a wider user base.

The IMF matters a lot. But its recent track record suggests that it has fallen behind, became less visible and less used. More of the same may no longer work. A reformed IMF toolkit is required to ensure the IMF can indeed play a prominent role in the global financial safety net.

1 World Bank, Quarterly External Debt Statistics, 76 countries SDDS participants; latest available data.

2 Minutes of the Executive Board Meeting 89/10 (IMF, 1989).