Private currencies: What are they, why they may make sense and how to regulate them

Prepared remarks, Workshop on regulatory issues of stablecoins, Financial Stability Board (FSB)

Monetary Authority of Singapore, Singapore, 6 February 2020

Ladies and Gentlemen,

I'm most grateful to the organisers for the invitation and opportunity to speak to you today. The topic of how to regulate private currencies is a critical and timely one. Not because there is a meaningful proliferation of private currencies as yet but greater regulatory clarity would help guide an orderly development of the sector. Libra has brought consideration for private currencies into the mainstream. The economic case for private currencies seems to be a strong one. Private currencies may resolve long-held monetary problems official currencies have failed to address. Successful private currencies are therefore most likely just a matter of time. I shall divide my brief remarks into: What are private currencies, why they may make sense and how to regulate them.

What are private currencies? Private currencies are issued by non-official entities to serve as settlement media. There is no consensus as to whether private currencies should actually be called currencies—a notion normally exclusively associated with payment media issued by central banks—but it seems fair to stipulate that private currencies can fulfil many of the basic functions of settlement media. Currencies are a subset of money. Most monies are already private of course, being liabilities of the financial sector. The adoption of private currencies is merely an extension of existing monetary aggregates. There is a priori no reason why private currencies could not serve as effective settlement medium. Private currencies are of course not new.

Private currencies were prominent through the early twentieth century. During the nineteen century In Europe, private currencies thrived with the proliferation of bank notes issued predominantly by private banks of issue. They were seen as essential innovation amid the need for new settlement media with the emerging industrialisation that made specie payment unduly impractical. In Germany in 1875 with the establishment of the first central bank in Germany, private banks of issue continue to operate a regional level similar to private banks of issue in Italy, Japan, Spain and Sweden and to some extent the country banks in Great Britain. In the United States, national bank notes remained in circulation through the 1930s even after establishment of the Federal Reserve in 1913.

The re-emergence of private currencies today rests on recent technology advances. The introduction of distributed ledger technologies (DLT), following the technology breakthrough of the bitcoin blockchain, has offered through tokenisation new functionalities for settlement media that can now reside on a new internet-based infrastructure outside existing financial system payment rails. Tokenisation makes currencies portable, that is, they can be transferred similar to sending a text offering new ways to make payment media available, exchange possibilities and lowering transaction costs.

Private currencies are floating or fixed rate. Fixed rate private currencies can be fixed to national currencies or a basket of national currencies and can be issued under provisions akin to a currency board. Stable coins are of course simply fixed rate private currencies pegged to some anchor, often a national currency. Issuers can be anonymous, non-financial and financial entities. Currencies issued by banks, de facto constitute negotiable bank deposits. They constitute a special category amid the effective extension and tokenisation of banks' balance sheets.

Private currencies are normally issued against national currencies. Where currencies are "mineable" as in the case of bitcoin, they are created from the mining effort and often subsequently exchanged for national currencies. Private currencies therefore ought not represent a monetary expansion but mere substitution of monetary liabilities. Overall, private currencies exhibit many very conventional national currency features.

Why do private currencies may make sense? Many official currencies exhibit a poor track record of monetary stability. Long standing grievances of the functioning of the international monetary system remain unresolved. The main limitation of national currencies is that they are national. Optimal currency areas are rarely the national territory, that is, it is not optimal to hold the national currency for a given set of transactions. Many national currencies have simply not offered the infrastructure to facilitate sufficient financial inclusion hampering participation in the formal economy and restricting social and economic mobility. The emergence of private currencies should therefore come as no surprise.

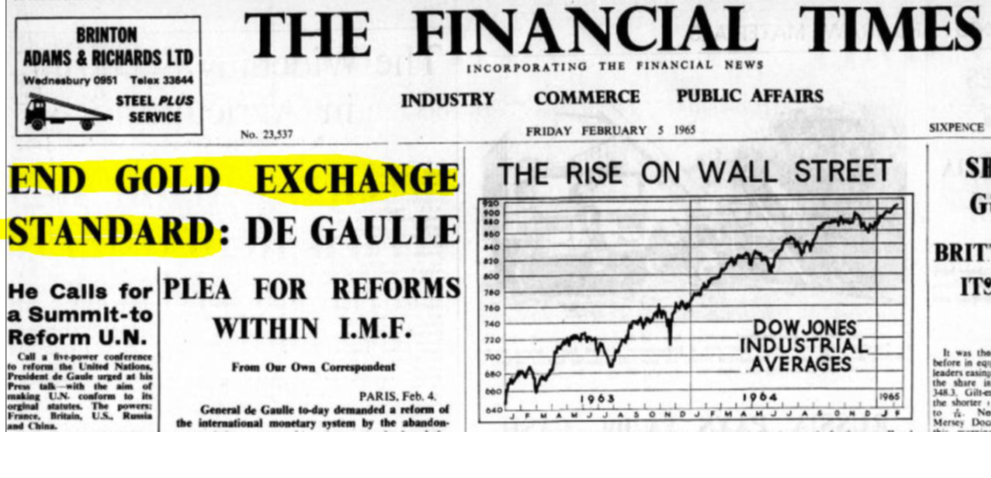

The fundamental deficiency of official currencies rests in the notion of "exorbitant privilege" articulated by French president Charles de Gaulle in 1965 almost exactly 55 years ago to the day. It remains as valid then as it is today and shall also serve as a reminder of how little progress has been made in monetary relations. De Gaulle's essential criticism, following insights offered by Robert Triffin and the famous Triffin dilemma, is that, currencies are issued to serve specific economic policy objectives that may or may not respond to the needs of economic agents. A neutral anchor for currencies is therefore needed. In the international sphere, payment media should not depend on the economic policy objectives of a given country. It can be extended to the national sphere where the national currency may be geared unduly to serve a certain group of economic agents, say exporters. De Gaulle's proposed remedy was to abandon the gold exchange standard (Bretton Woods System) and return to the gold standard as he saw in gold that neutral anchor (Figure 1). Other proposals envisaged an international currency issued by the International Monetary Fund (IMF) that was also only most timidly implemented with the Special Drawing Right (SDR).

Figure 1. "Exorbitant privilege"

How to regulate private currencies? The starting point for any consideration for regulation should be that it is legal in most countries to pay in any currency one likes as long as the payee accepts it. Private currencies are like foreign currencies from a domestic point of view. Currencies are normally not regulated as financial instruments and spot transactions are also mostly unregulated. Regulation should not focus on the currency but on the fiduciary periphery of the currency, that is, all entities handling the currencies and offering services in relation to the currency. The existing framework covering foreign exchange in domestic jurisdictions should be sufficient to accommodate private currencies. An impairment of financial stability is given if adoption of private currencies will be very large and private currencies are denominated in units of account other than the national currency. Additional prudential safeguards, akin to mitigating dollarization, may need to be considered.

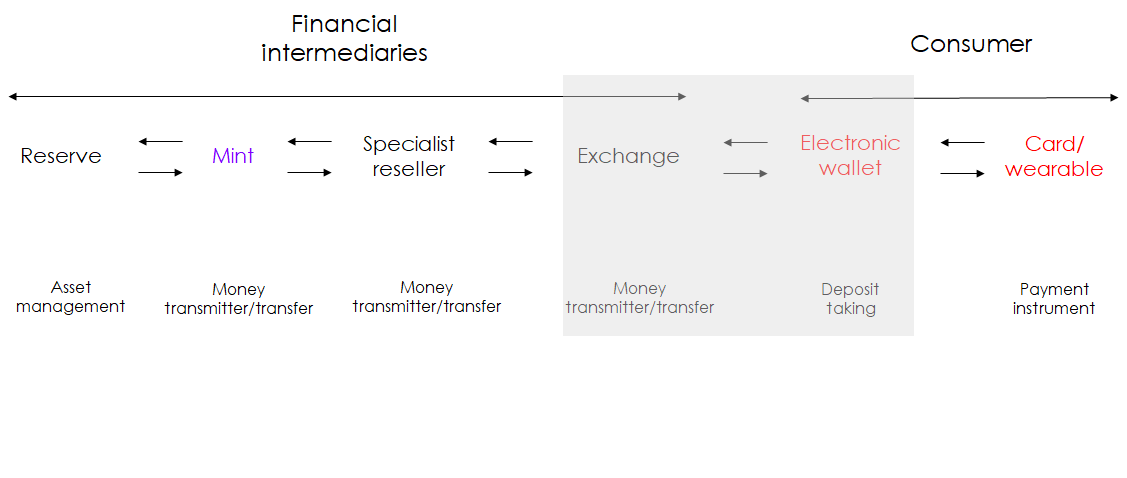

The regulatory framework should distinguish the different activities related to private currencies. Depending on the exact set-up, the life cycle of private currencies comprises the reserve, the mint, specialist resellers, exchanges, electronic wallets and payment instruments including mobile apps, cards and wearables. The reserve constitutes a claim of the mint and normally is owned by the mint. Specialist resellers acquire the currency from the mint against national currencies and offer the currency on exchanges. End-users tender national currencies in exchanges in receipt of the private currency and hold the private currency in an electronic wallet. Mobile apps, cards and wearable can be used as payment instruments (Figure).

Figure 2. Private currency life cycle

The regulatory approach should naturally rest on the notion that same risks should attract same regulations. The reserve would have to be subject to provisions guiding any asset management operation. As a claim of the mint this would not involve any end-user interests. The mint fulfils a function of a money transmitter. The specialist resellers also fulfil functions as a money transmitter. The exchange could be deemed an exchange or also a money transmitter depending on the extend of its operations. The electronic wallet would be akin to a deposit holding vessel and may attract provisions for bank accounts or money transmitter consumer accounts given the very narrow functions of the wallets. The payment instruments should be subject to similar regulations as comparable payment instruments. The importance is where end-consumers interact with the currency and often those may be only indirect relationships.

To conclude, private currencies are likely to be most successful in the international domain. They may also play an essential role for financial inclusion if and only if they can provide the needed distribution infrastructure and can solve for the difficulty of bringing payment media into circulation. The emergence of private currencies should not surprise amid the track record of official currencies and their inherent limitations. Adoption will therefore likely be higher where the monetary infrastructure is poor and/or the national currency is highly unstable. There is little to suggest that the regulatory treatment of private currencies should differ from any foreign currency.

The adoption of private currencies will depend like with all currencies on whether end-users perceive to be better off holding them. The critical question guiding end-users will be if they benefit from fixing to the private currency and float against the national currency or fix against the national currency and float against the private currency. Private currencies are set to alter the geography of currency holdings.

As a final thought, while the idea of private currencies to act as effective international currencies is intriguing, international currencies, while highly desirable in theory, are very hard to put in place in practice amid the difficulty of finding the "optimal" numeraire. Private currencies will have to prove they are better at tackling those issues the official sector has failed to solve. For many countries the bar though may not be that high.